At ABR, we see value creation opportunities where many other real estate investors do not. We are ambitious. We have big ideas and high expectations. We foster creativity and collaborate with our network of operating partners to develop ideas that drive new paths to value creation. Our time-tested approach has allowed us to invest successfully across multiple investment cycles.

A Passion for What’s Possible

We Focus on What Matters Most: Building Value for Our Clients

Middle Market Focus

ABR Leverages Inefficiencies

in the Middle Market

ABR takes a focused yet flexible approach regarding market, property type, and capital structure, with a goal of maximizing risk-adjusted returns at the asset and portfolio level. We do this by proactively targeting specific investment types given existing market conditions. ABR targets markets that exhibit strong long-term economic drivers and favorable supply / demand dynamics and assesses opportunities across a variety of commercial real estate property types.

Investment Strategy

We target and generate returns across markets by exploiting market inefficiencies, we capitalize on situational distress and transitional assets, and we actively manage our real estate assets to optimize value creation. Our investment strategy balances an opportunistic approach with a focus on reducing downside risk.

Value Creators

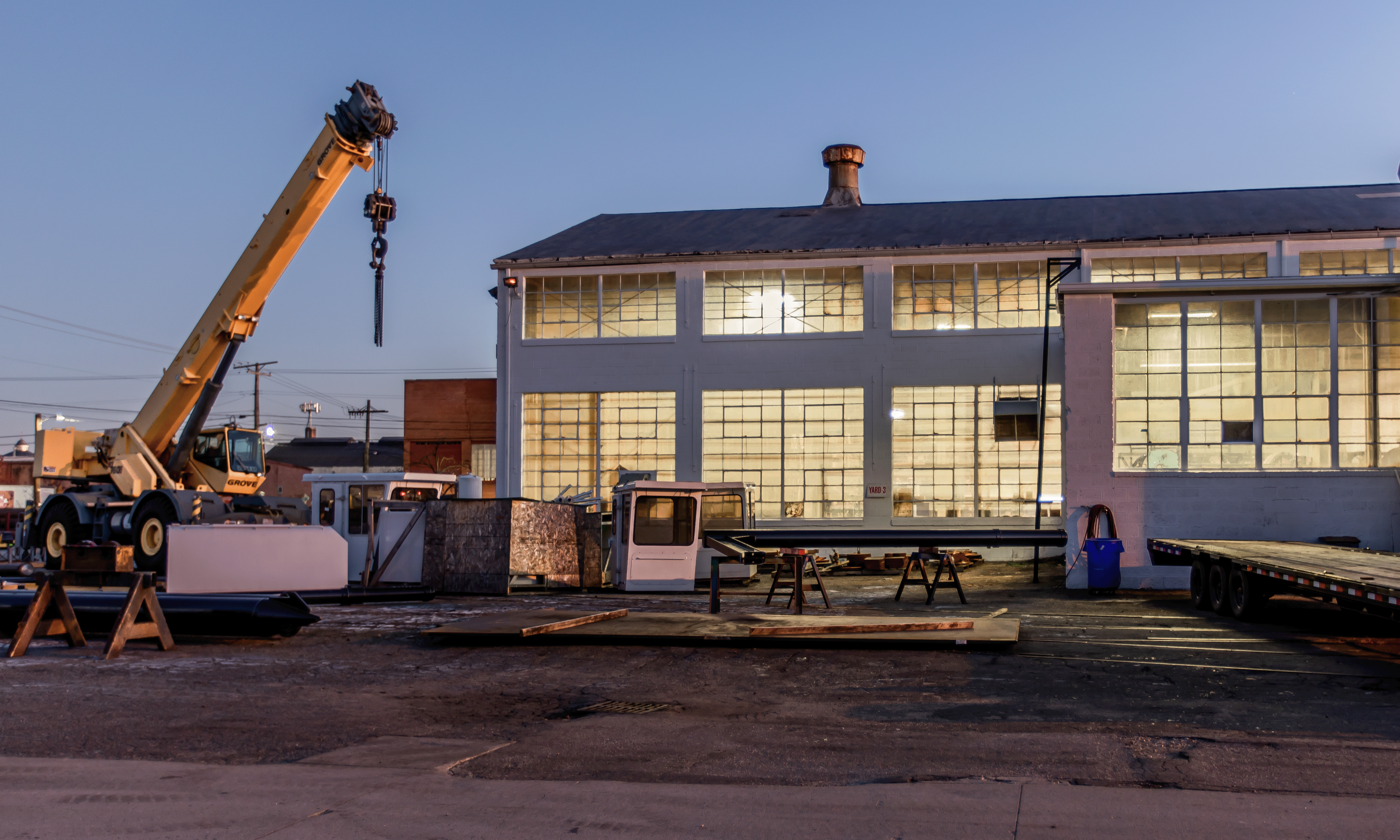

ABR seeks to maximize risk-adjusted returns by employing a fundamental value-add approach to investing. This involves targeting high-quality, well-located assets with intrinsic long-term value that often require development, redevelopment, rehabilitation, repositioning or financial restructuring.

Disciplined Approach to Investing

We Invest in Sectors

We Know Best

ABR follows a disciplined, bottom-up process and casts a wide net over hundreds of potential real estate investments. We aim to uncover the very best opportunities to deliver strong returns to our investors. We are experienced, strategic, patient investors, and we follow proven strategies focused on capital preservation through detailed underwriting and optimal execution.

Asset Management

Maximizing Cash Flow through

Active Asset Management

ABR maintains a proactive focus on maximizing cash flow through active asset management, including management of operating expenses, implementation of appropriate capital expenditure programs, repositioning under-utilized assets, and re-leasing vacant space as well as other revenue enhancement initiatives.