Baltimore, MD – Alex. Brown Realty (ABR) and joint venture partner Woods Grove Capital are pleased to announce the acquisition of a three-building industrial portfolio located in the Carroll-Camden Industrial Park in southwest Baltimore, Maryland. ABR Chesapeake Fund VI, a value-add real estate fund sponsored by ABR, invested $5.5 million in the joint venture. Financing for the acquisition was provided by a first mortgage loan from Aetna Life Insurance Company.

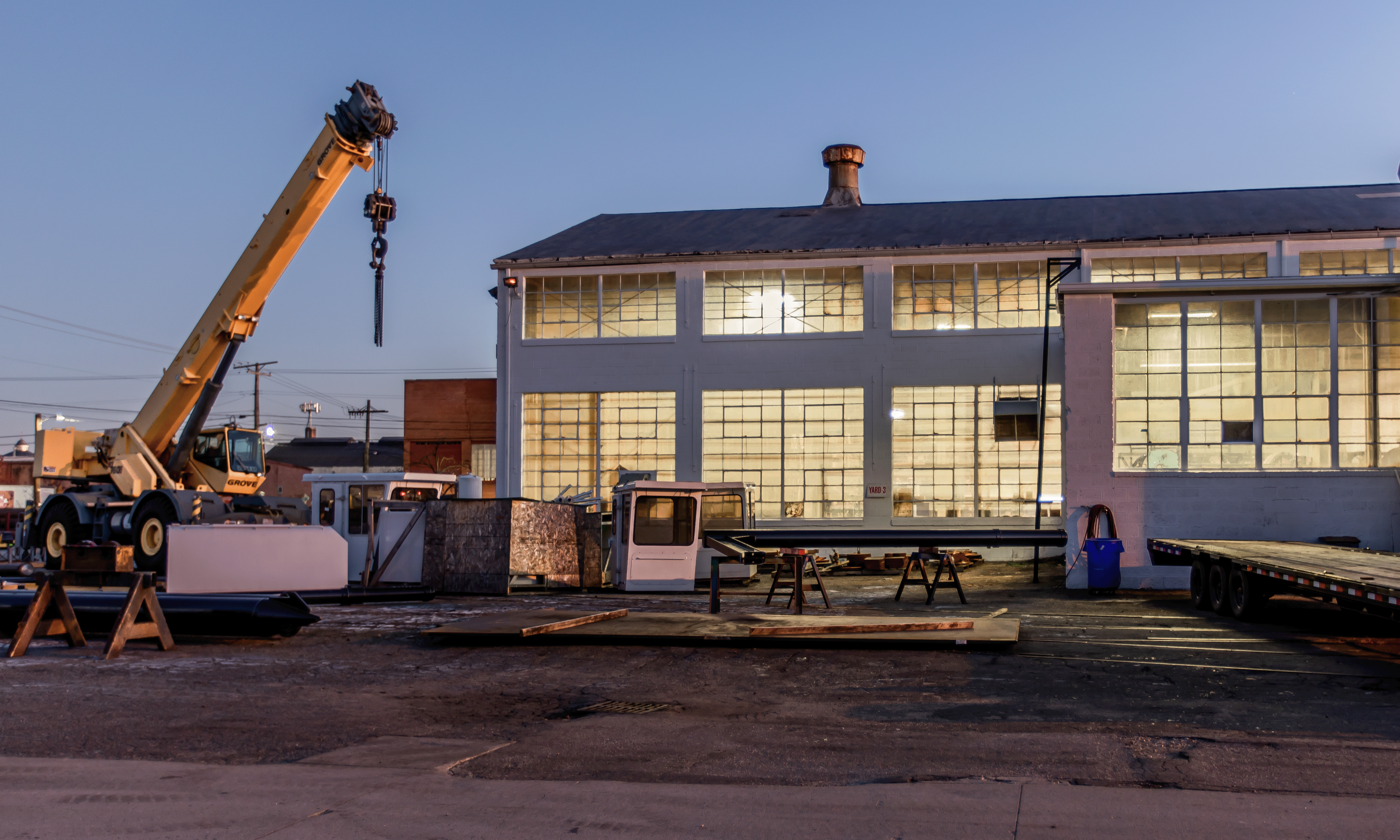

The portfolio is 100% occupied by six tenants and collectively contains over 195,000 net rentable sf of industrial space. The buildings average less than 10% office buildout and feature 17’-50’ clear heights, 4 loading docks, 11 drive-in doors and 128 surface parking spaces. Two of the buildings have crane service and one of the buildings has rail service. All three properties in the portfolio offer plenty of outdoor storage. The properties offer easy access to Interstate 95, the main CSX Rail Yard, and the Seagirt Marine Terminal at the Port of Baltimore.

The joint venture acquired the portfolio in an off-market transaction. “Demand for industrial and warehouse assets throughout the region has remained strong despite the current economic conditions,” said David Archibald, Chief Investment Officer of Woods Grove. “We were grateful to have been presented with this opportunity and by-pass the public marketing process,” added Archibald.

“ABR has deep roots in Baltimore, and we are pleased to be investing locally,” stated Tom Burton, ABR’s Senior Managing Director and Chief Investment Officer. “We look forward to working with Woods Grove to add value to the portfolio and generate strong returns for our investors.” The transaction marks the first joint venture between ABR and Woods Grove.

Alex. Brown Realty (ABR) is an independent real estate investment manager specializing in value-add, opportunistic, and core-plus investments in the middle market. The firm was founded in 1972 by the partners of Alex. Brown & Sons, a Baltimore-based investment bank organized in 1800. Since the inception of the firm, ABR has acquired over $4 billion of assets, representing over 400 transactions. ABR has sponsored five real estate funds and is currently marketing its sixth fund. The firm is an SEC-registered investment advisor. www.abrealty.com

Woods Grove Capital is a Connecticut-based real estate investment company focused on the development and renovation of industrial properties. Woods Grove was founded by David Archibald and Drew Dewitt.